Indonesia is making a bold $19 billion play to ward off crushing U.S. tariffs. The proposed 32% tax threatens to devastate palm oil exports and flip-flop markets, putting millions of farmers at risk. Chief Economic Minister Hartarto‘s strategy? Buy American goods – lots of them. From natural gas to machinery, Indonesia aims to slash its $16.8 billion trade surplus with the U.S. The clock’s ticking on this high-stakes economic chess match.

Three million Indonesian farmers are holding their breath as Jakarta makes a bold $19 billion play to avoid crushing US tariffs. The stakes couldn’t be higher – a proposed 32% tariff threatens to devastate exports of everything from palm oil to flip-flops, potentially wreaking havoc on the livelihoods of 2.5 million smallholder farmers.

Indonesia’s not taking this lying down. In a classic “let’s-make-a-deal” move, they’re dangling a massive carrot: promises to buy up to $19 billion worth of American goods. We’re talking liquefied natural gas, fancy machinery, and agricultural products. It’s quite the shopping spree, aimed at closing that pesky $16.8 billion trade surplus Indonesia’s been enjoying. Like a well-managed income portfolio, Indonesia seeks steady economic returns through diverse trade agreements.

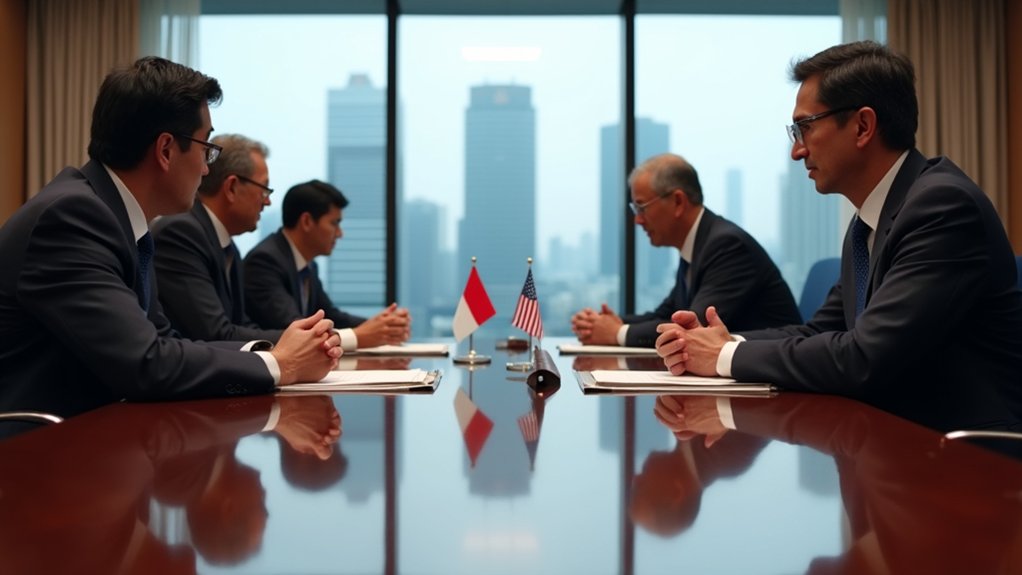

Chief Economic Minister Airlangga Hartarto is leading the charge, backed by a squad of senior ministers including Finance Minister Sri Mulyani. They’re headed straight for the belly of the beast – meetings with top brass at the US Departments of Commerce, State, and Treasury. Talk about a power lunch circuit. The delegation is pushing to ease local content requirements to attract more US investment. The 90-day pause on tariffs gives Indonesia’s team a tight window for negotiations.

The clock’s ticking, though. Indonesia’s got just 90 days before these tariffs could become permanent. That’s why they’re throwing everything at the wall – including plans for state-owned enterprises to invest in US energy and tech sectors. Smart move? Maybe. Desperate? Possibly. But when your palm oil industry’s facing potential overcapacity and your textile makers are sweating bullets, you do what you have to do.

Here’s the kicker: while Indonesian officials are busy schmoozing in Washington, producers back home aren’t sitting idle. They’re already scanning the horizon for Plan B – alternative markets in Europe, Africa, and the Middle East. Because let’s face it, when you’re staring down the barrel of trade restrictions from your biggest customer, you’d better have a backup plan.

For now, millions of Indonesian workers and farmers can only wait and watch as their government plays this high-stakes game of economic chicken with the world’s largest economy.