The Rule of 72 is a simple math shortcut that estimates how long it takes money to double. Invented in 1494 by mathematician Luca Pacioli, it works by dividing 72 by the annual interest rate percentage. With an 8% return, money doubles in 9 years. With 6%, it takes 12 years. While not perfect, it’s handy for quick mental calculations – no calculator needed. There’s more to this ancient financial trick than meets the eye.

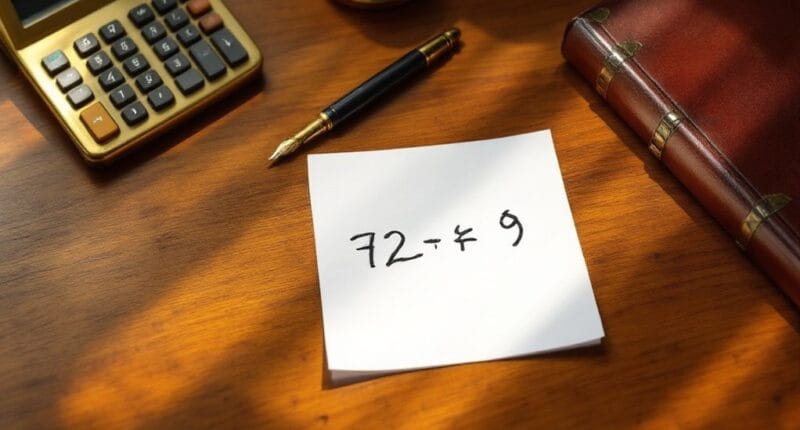

Money math doesn’t have to be complicated. In fact, one of the most useful financial calculations ever devised fits on a Post-it note: the Rule of 72. This mathematical shortcut, first introduced by Luca Pacioli in 1494, helps anyone figure out how long it takes for money to double. No fancy calculators required.

The concept is ridiculously simple. Take the number 72 and divide it by the annual rate of return. That’s it. The result tells you how many years until your money doubles. For example, with an 8% return, it takes 9 years to double (72 divided by 8). With a 6% return, it takes 12 years. Even a middle school student could handle this math. For greater accuracy with lower returns between 2% and 5%, some experts recommend using the Rule of 70 instead.

Want to know your money’s doubling time? Just divide 72 by your annual return rate. Simple math, powerful results.

But here’s the catch – this rule isn’t perfect. It works best with interest rates between 5% and 10%. Outside that range, the accuracy gets a bit wonky. The formula has a 2% margin of error in its calculations. And it only works with compound interest, where you’re earning interest on your interest. Simple interest? Different story entirely.

The Rule of 72 isn’t just for investment nerds. It’s actually pretty handy for understanding some depressing realities about money. Want to know how quickly inflation will cut your purchasing power in half? Use the rule. Wondering how fast that high-interest credit card debt will double? Same rule. It even works for estimating population growth or GDP expansion. Understanding this rule is essential for stock market returns and building long-term wealth through investments.

Financial planners love this rule because it makes complex concepts digestible. It helps explain why fees matter (they extend doubling time) and why small differences in return rates can have huge long-term impacts.

But let’s be clear – it’s not magic. The rule assumes steady interest rates and annual compounding, which rarely happen in real life. Taxes, fees, and market volatility don’t fit neatly into this equation.

Still, for quick mental math and basic financial understanding, the Rule of 72 is tough to beat. It’s been helping people grasp compound interest for over 500 years. Not bad for a medieval mathematician’s party trick.

Frequently Asked Questions

How Accurate Is the Rule of 72 Compared to Actual Compound Interest Calculations?

The Rule of 72 provides reasonably accurate estimates between 6-10% interest rates, with error margins of 2.4-14% when compared to actual compound interest calculations.

Can the Rule of 72 Be Used for Calculating Depreciation Rates?

The Rule of 72 effectively calculates depreciation rates by dividing 72 by the annual depreciation percentage. It estimates how long assets take to lose half their value under constant depreciation.

Does the Rule of 72 Work for Monthly or Weekly Compound Interest?

The Rule of 72 works for monthly and weekly compound interest when adjusting the interest rate to match the compounding period, though additional modifications may improve accuracy for frequent compounding schedules.

Why Isn’t It Called the Rule of 70 or 71?

The number 72 was chosen due to its mathematical convenience, having many divisors (2,3,4,6,8,9,12) which makes mental calculations easier than 70 or 71 would allow.

Which Investment Types Are Best Suited for Rule of 72 Calculations?

Fixed income securities like bonds and CDs, fixed annuities, and stable dividend-paying stocks are best suited for Rule of 72 calculations because they provide consistent, predictable annual returns.