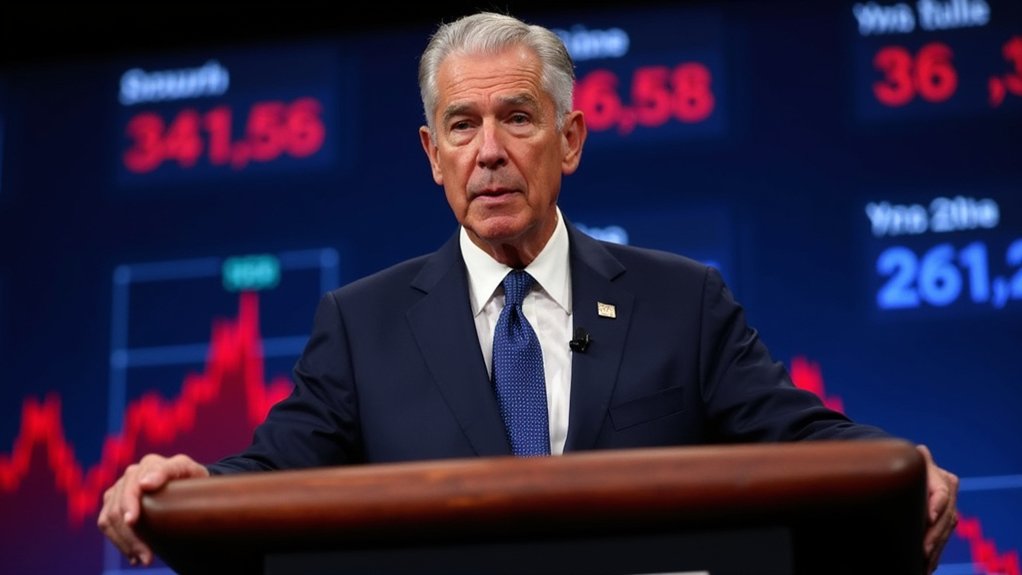

Federal Reserve Chair Jerome Powell isn’t buying Trump’s rosy tariff claims. Market chaos speaks volumes – tech stocks hemorrhaging $3.8 trillion, major indices tumbling, and inflation hitting 9%. Powell warns that trade policies are hammering American households while foreign exporters dodge costs. Despite Trump’s Twitter tantrums and “Mr. Too Late” jabs, Powell stays focused on economic data. The brewing storm between monetary policy and political pressure tells quite a tale.

While Trump continues to tout his tariffs as a win for America, Federal Reserve Chair Jerome Powell isn’t buying it. In fact, Powell’s warnings about inflationary risks from Trump’s trade policies couldn’t be clearer – those import duties are hitting American households right in the wallet. And no, contrary to Trump’s claims, foreign exporters aren’t footing the bill.

The markets aren’t loving it either. The numbers tell a brutal story: tech stocks have hemorrhaged $3.8 trillion since Trump took office, with the Nasdaq down 13%, the S&P 500 dropping over 8%, and the Dow sliding nearly 7% in 2025. The dollar index slid to its lowest point since 2022, showing investors’ waning confidence in U.S. assets. Talk about a rough ride. The widening bid-ask spreads in major indices indicate severely diminishing market liquidity.

Powell’s got his hands full, trying to thread the needle between rising inflation and slowing growth. It’s a mess, really. Some trade with China has completely frozen, and Powell admits the Fed’s tools can’t fix both problems at once. Inflation hit a staggering 9 percent peak in July 2022. Not exactly a comfort to investors watching their portfolios shrink.

Fed Chief Powell faces an impossible balancing act as inflation surges while growth stalls, leaving investors increasingly nervous.

Meanwhile, Trump’s running his usual playbook – attacking Powell as “Mr. Too Late” and demanding interest rate cuts like they’re Halloween candy. He’s even threatened to fire Powell, though his advisors managed to talk him down from that particular ledge. Legal authority to do so? Not quite there, Donald.

But Powell isn’t backing down. Despite the pressure, he’s standing firm on the Fed’s independence, with Congress firmly in his corner. The Fed chair keeps it professional, letting the economic data guide his decisions while Trump throws Twitter tantrums.

The upcoming months look interesting, to say the least. The Fed’s expected to hold rates steady in May, with June possibly bringing some cuts.

But here’s the kicker – while Trump claims his tariffs are making America stronger, Powell sees a different reality: rising prices, market chaos, and economic uncertainty. Sometimes the truth hurts, especially when it comes wrapped in trade barriers and political pressure.