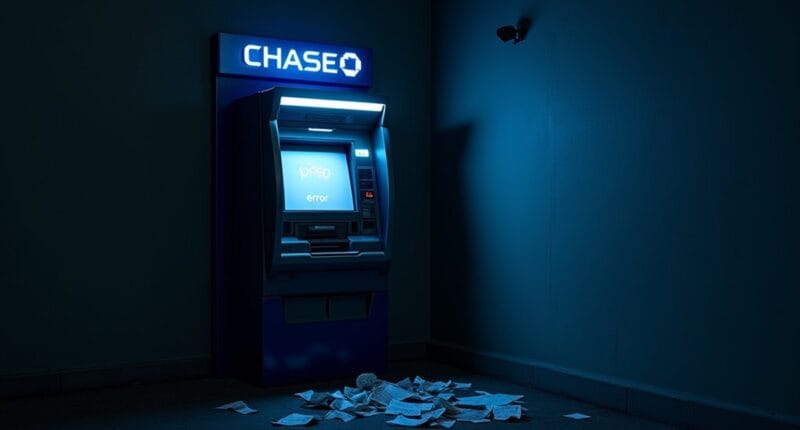

A viral TikTok trend promoting an “Infinite Money Glitch” backfired spectacularly when thousands of users tried exploiting JPMorgan Chase‘s check-processing delays. The scheme involved depositing fake checks at ATMs and withdrawing funds before detection. Now, JPMorgan Chase is hitting back with lawsuits against fraudsters, some facing negative balances over $300,000. What started as social media bragging rights turned into frozen accounts and criminal charges. The full story reveals just how badly this “glitch” played out.

While social media trends usually involve dance moves or lip-syncing, TikTok users in late 2024 decided to try their hand at something more ambitious: bank fraud. The viral “Infinite Money Glitch” trend spread like wildfire, with influencers and anonymous users posting videos showing how to exploit banking processes at JPMorgan Chase ATMs.

Because nothing says “smart life choices” quite like broadcasting your crimes to millions.

The scam wasn’t exactly rocket science. Fraudsters deposited fake checks at Chase ATMs or through mobile banking, then withdrew the temporarily credited funds before the bank could catch on. They marketed it as discovering a “glitch” in the system. The trend gained massive traction after a viral Tweet showing a fake $80,000 check deposit. The bank is seeking punitive damages from participants who exploited the system.

A classic check fraud scheme repackaged as a trendy “hack” – same scam, new social media wrapper.

Spoiler alert: deliberately exploiting check-clearing delays isn’t a glitch – it’s just good old-fashioned check fraud.

Chase didn’t find it nearly as entertaining as TikTok did. The bank swiftly froze thousands of accounts and started slapping lawsuits on the biggest offenders. Some participants found themselves staring at negative balances north of $300,000 when their fraudulent checks inevitably bounced.

Turns out, “infinite money” has very finite consequences.

The scale was staggering. JPMorgan investigated thousands of potential cases, with one lawsuit citing withdrawals exceeding $290,000. The bank partnered with law enforcement to track down perpetrators, who now face both civil and criminal charges.

Those viral videos suddenly seem a lot less clever from inside a courtroom.

The banking industry responded by tightening security measures and monitoring systems. But the real story here isn’t about technical vulnerabilities – it’s about how social media can turn financial crimes into trending entertainment.

What started as TikTok bragging rights ended with frozen accounts, criminal records, and massive debts. The “Infinite Money Glitch” turned out to be anything but infinite, leaving participants with empty accounts and very real legal troubles.

Sometimes the most expensive lessons come from free advice on social media.