Former crypto darling Alex Mashinsky will spend 12 years behind bars for defrauding investors through his now-collapsed Celsius platform. The founder, who pleaded guilty to two fraud counts in December 2024, received his sentence from Judge Koeltl in New York despite his defense team’s pleas for leniency. Mashinsky’s dramatic fall from grace, which included withdrawing $8 million before freezing customer accounts, serves as a stark reminder that crypto isn’t immune to old-school fraud. The story behind his downfall reveals an even darker tale.

Alex Mashinsky, the founder of failed cryptocurrency platform Celsius, will spend the next 12 years behind bars for orchestrating a massive fraud scheme that devastated countless investors.

The sentence, handed down by Judge John G. Koeltl in the Southern District of New York on May 8, 2025, fell short of the 20-year prison term prosecutors wanted but certainly exceeded the laughably lenient one-year stint his defense team requested.

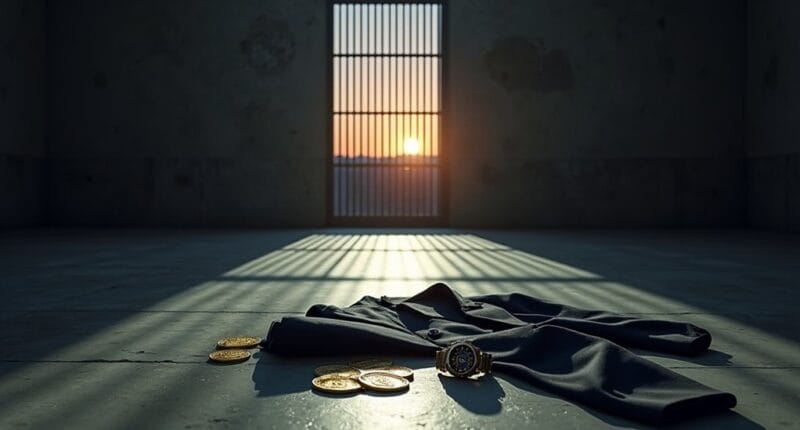

Showing up in his carefully chosen black suit and blue tie, Mashinsky learned his fate after pleading guilty to two counts of fraud in December 2024.

Dressed in courtroom finery, the fallen crypto mogul faced justice after admitting to his fraudulent scheme months earlier.

The collapse of Celsius in 2022 sent shockwaves through the crypto world, predating the spectacular implosion of FTX. Mashinsky, who built the cryptocurrency lending platform into a market powerhouse, tried playing the sympathy card during proceedings. His defense team pointed to his refugee background and military service. They even attempted to paint him as a noble figure “taking responsibility for 1,000 employees.” Nice try.

Prosecutors weren’t buying it. They systematically dismantled claims that market forces were to blame, arguing that Mashinsky’s actions were “deliberate, calculated decisions to lie, deceive, and steal.” This wasn’t a case of bad luck or naiveté – it was straight-up fraud for personal gain. His crimes included withdrawing $8 million in assets just before freezing customer accounts.

The platform’s promises of high-yield returns to depositors set it apart from traditional banks, ultimately contributing to its downfall.

The significance of this sentence extends far beyond one man’s fate. It’s a wake-up call for the entire cryptocurrency industry, demonstrating that traditional fraud laws apply just as much to digital assets as they do to traditional finance.

The U.S. Attorney made that crystal clear: rules against fraud still matter, even in crypto.

For Mashinsky, the next dozen years will be a far cry from his days as a crypto star. The sentence serves as a stark reminder that white-collar crime in the digital age carries real consequences.

No amount of technical jargon or blockchain buzzwords can obscure the simple truth – fraud is fraud, whether it’s done with cryptocurrencies or cold, hard cash.